A guide to reading your annual rates notice

Published on 05 September 2024

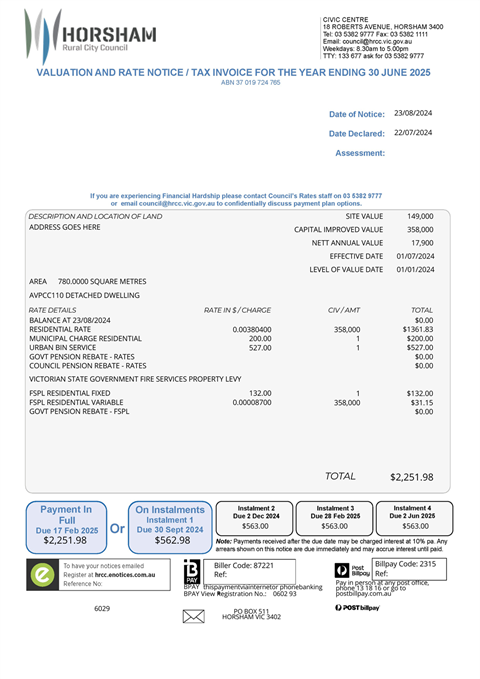

Horsham Rural City Council’s annual rates notices are being distributed to all ratepayers. We’ve put together a handy guide on how to navigate your rates notice.

Most information on your rates notice should be easy to understand, however we recognise that some detailed financial information can be more challenging.

The below guide has been developed to assist you with better understanding your annual rates notice. There is also some additional information on the reverse of your annual rates notice which will also assist.

If you are still unclear about your annual rates notice, or if you are experiencing financial hardship, you can contact our customer service team on 5382 9777 or rates@hrcc.vic.gov.au.

Property valuation

This section of your annual rates notice outlines the value of your land and property. This value determines the amount of rates you pay to Council each year. Council is not involved in deciding how much a property is worth. The Valuer General’s office values all properties in Victoria annually.

Valuers determine valuations by collecting and analysing property sales, planning and building permits, planning information, external and internal inspection data, and occupancy data.

These valuations are provided to Council for use in calculating rates. If you disagree with your property valuation, objections must be lodged directly with the Valuer General within two months of the date of issue of the rates notice.

Site value

Site value is the value of the land only and does not include the value of any improvements such as buildings.

Capital improved value

Capital improved value (CIV) is the assessed market value of both the land and any improvements such as buildings.

Net annual value

Net annual value (NAV) for residential and primary production properties is five per cent of a property’s CIV. For non-residential properties, NAV is the greater of either the estimated annual market rental of the property minus all legislated expenses to maintain that property (except council rates) or 5 per cent of CIV.

Rates and charges

This section of your annual rates notice outlines the different expenses listed in your rates notice.

Balance as at date of issue

This line item shows any rates or charges that have been carried over from the previous financial year.

Fire services levy

This levy is collected on behalf of the Victorian Government to fund the operation of the Metropolitan Fire and Emergency Services Board and the Country Fire Authority. Calculated based on CIV.

General rate

General rates are collected by Council to fund all of the services provided by Council other than those included in the separated waste service charges. This includes libraries, leisure centres, maintaining our parks and public spaces and much more.

Waste charge

Waste service charge for a residential property.

Total

This is the total amount owing to Council for 2024/25.

Preferred payment options

The rates notice includes options to pay in full or by quarterly instalments:

If you wish to pay your rates by instalments, please ensure that you pay your first instalment as outlined on your annual notice by 30 September 2024.

If the first instalment is not paid by the first instalment due date then you will automatically be required to pay your rates in full by 17 February 2025. Notices for the second, third and fourth instalments will be forwarded at least 14 days prior to the due dates. Please note that the first instalment includes any arrears and interest carried over from 2023/2024.

Options for paying your Council rates:

Online using your Credit Card

You can pay your Council rates, animal registrations and debtor bills via Post Billpay using your mastercard or visa card online and quoting the Billpay code and reference number on your notice.

Pay Online Now

You can also make payments by using BPay through your internet banking.

Call Post Billpay on 131816.

In Person

Payments can be made during office hours at the Civic Centre, 18 Roberts Avenue, Horsham or at any Australia Post Office.